A Clear Path Forward in an Uncertain Environment

As we begin the new year, our first focus is on client service. A brief refresher can help ensure you’re always connected to the right person and in the most efficient way.

How to Reach Us

For scheduling meetings, document requests, and general service questions, it is best to email or call Katie Guglielmo:

Email: katie@rsmawealthmanagement.com

Phone: 503-450-0550

Katie coordinates calendars, assists with paperwork, and helps prepare for meetings so conversations remain focused and productive. If you’re ever unsure where to start, calling or emailing the office is always appropriate. We’re happy to help direct your request.

Email Communication

From time to time, we send important communications related to market/planning updates, scheduling, client events, etc. from our client service inbox: clientservice@rsmawealthmanagement.com.

To ensure you don’t miss these messages, we encourage you to:

Keep an eye on emails from members of our team or RSMA Wealth Management

Consider adding our email address to your safe sender list

Check your spam or junk folder if you’re expecting something

These small steps help ensure timely communication throughout the year.

Texting and Professional Requests

To keep requests organized and ensure prompt follow-up, we ask that clients avoid texting personal cell phones for professional or service-related requests.

Instead, please call or email the office so your request can be properly tracked and directed to the right team member. This helps prevent delays and ensures nothing gets missed if someone is away or out of the office.

Education and Ongoing Support

In addition to ongoing planning work, we continue to invest in client education—covering both technical topics and the broader decisions that shape long-term planning. Over the past year, that include a webinar on ‘death planning,’ held in conjunction with Heartwood Collective. We’re also developing resources designed to help clients navigate areas like estate planning, family conversations, and other important but often overlooked aspects of financial life.

Looking ahead, we plan to offer additional educational webinars and resources throughout 2026, and we look forward to continuing those conversations with you. If you have any feedback or ideas for what you’d like to learn more about, please do not hesitate to reach out and let us know.

Financial Planning at RSMA: Scope, Structure, and Support

As part of our commitment to providing thoughtful, consistent advice, we want to take a moment to clarify the scope of our financial planning engagement and how we structure our work together.

RSMA’s financial planning relationships are designed around a defined, proactive planning cadence. This includes two scheduled planning meetings per year, which are intentionally structured to address investment strategy, planning topics, and new considerations in a focused and comprehensive way.

To help set expectations, it may be useful to distinguish between routine administrative requests and advisory work that benefits from a dedicated planning conversation.

Administrative and transactional matters—such as scheduling, money movement requests, and documentation needs—are always welcome and can be handled as they arise.

For advisory-related matters, however, our preference is to address them within the planning structure we’ve established:

Investment analysis, planning questions, or new topics introduced outside of scheduled meetings are typically best handled during your next regularly scheduled planning meeting

If a topic is time-sensitive or warrants additional discussion, we are happy to schedule an additional meeting when appropriate

From time to time, requests may arise that fall outside the agreed scope of the planning engagement or require additional research, analysis, or preparation beyond our standard planning process. In those situations, work outside the scope of the annual retainer may be billed at our standard hourly rate, subject to prior discussion and approval.

Our goal in clarifying this structure is not to limit engagement, but to ensure that our time together is used effectively and that our planning work remains thoughtful, consistent, and sustainable across all client relationships.

If you’re ever unsure whether a request fits within the scope of your planning relationship, we encourage you to ask. These conversations help maintain clarity and allow us to focus on the areas that matter most.

Amid Uncertainty, Staying Grounded in Data

As we reflect on 2025, it’s clear the year unfolded during a period of unusually high uncertainty. Political divisions, shifting policy priorities, and broader social tensions contributed to an environment that often felt unsettled.

At the same time, one of the defining features of the year was the contrast between the intensity of the news cycle and the underlying strength of economic and corporate fundamentals. Markets, by their nature, are less focused on headlines and more attuned to growth, earnings, and financial conditions. Investors would be wise to do the same.

From an economic standpoint, the U.S. continued to grow in 2025. Consumer spending remained resilient, supported by steady employment and household balance sheets that, in aggregate, stayed on solid footing. While tariffs, inflation and somewhat elevated interest rates continued to influence behavior, neither proved disruptive enough to derail overall economic activity.

From an earnings standpoint, the term “AI bubble” started to appear everywhere in the second half of last year, which perhaps made it easier to assume that stock market gains were being driven by excessive risk-taking and multiple expansion—not earnings.

But that was not actually the case in 2025.

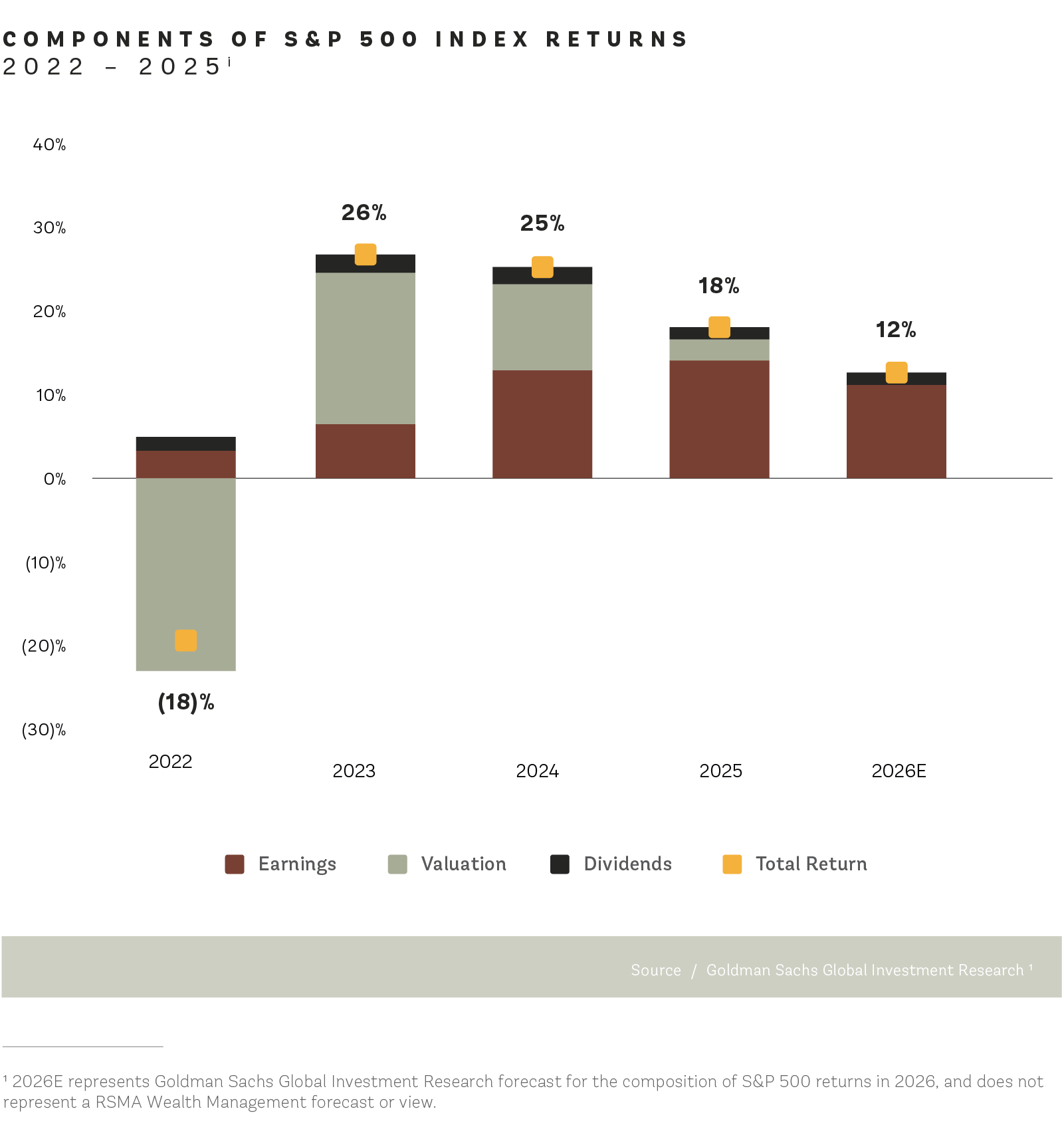

The bulk of equity market appreciation (14% of the S&P 500’s 18% gain) came from earnings growth:

Many companies demonstrated an ability to adapt to tariff-driven uncertainty, managing costs, preserving margins, and investing selectively. This earnings resilience helped provide a fundamental anchor during periods of market volatility.

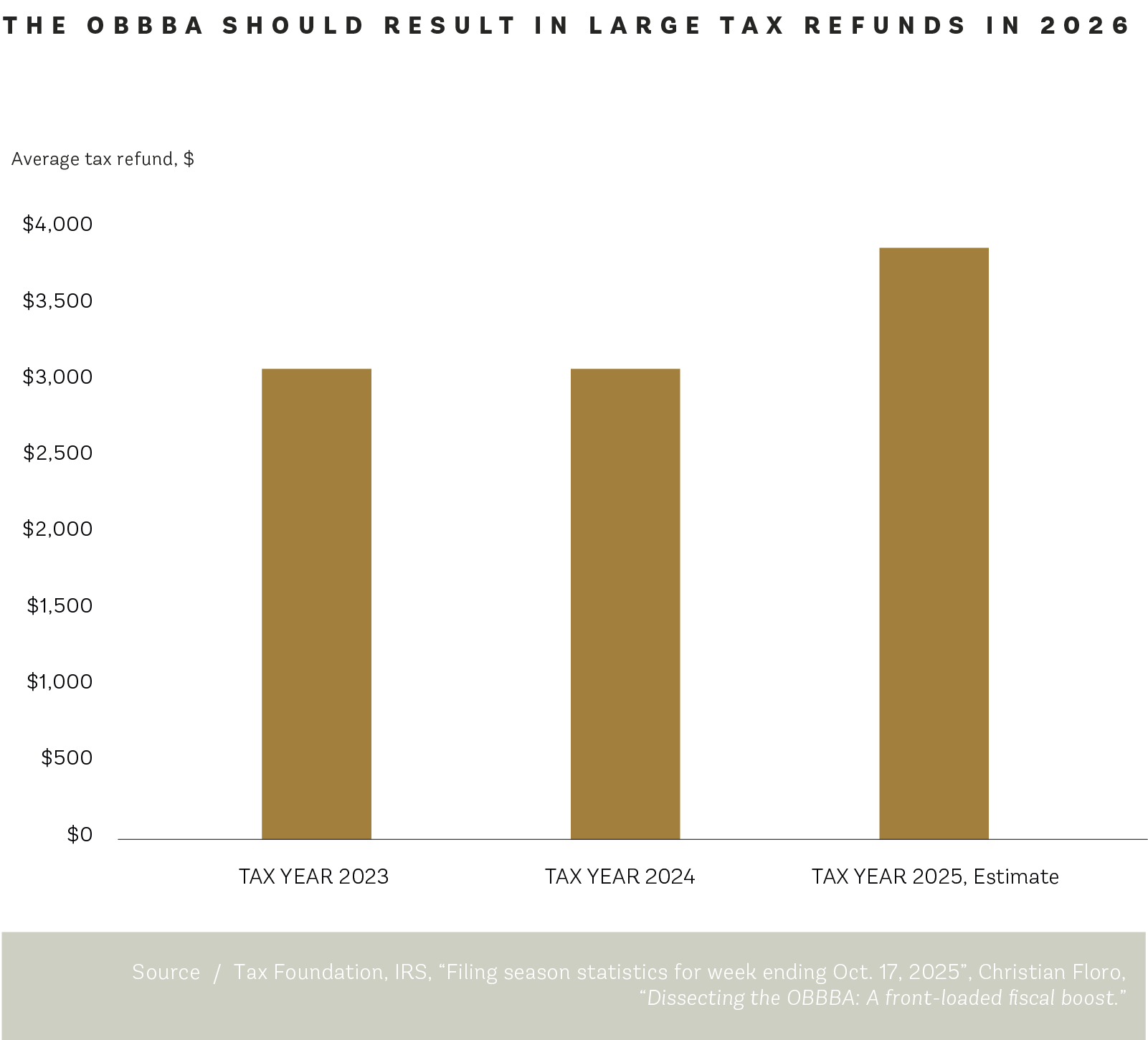

Monetary policy also shifted from being largely neutral to a more supportive factor as the year progressed. With inflation pressures easing from earlier peaks and labor markets gradually cooling, financial conditions became less restrictive. In 2026, we can also reasonably expect fiscal policy to serve as a tailwind. The Trump administration has signaled its intent to dial-up fiscal stimulus in various forms, and the impact of the OBBBA should be significant for businesses and households this year (see chart below).

That said, 2025 was far from a smooth ride. Markets experienced several sharp pullbacks tied to policy uncertainty, geopolitical developments, and concerns about the durability of growth. These episodes served as reminders that volatility tends to rise when confidence is fragile, even when underlying fundamentals remain intact.

Looking ahead to 2026, uncertainty remains elevated. Political and policy developments, both domestic and global, will continue to influence sentiment, and we would expect market volatility in response to unexpected policy changes or surprises. At the same time, the fundamental supports that carried the economy through 2025, like ongoing growth, corporate profitability, and more balanced financial conditions, remain in place for now. While growth may continue to moderate as policy headwinds come into play, moderation is not the same as contraction.

At RSMA, our focus remains on helping clients navigate periods like this with perspective and discipline. We acknowledge the uncertainty that defines the current environment, but we also remain grounded in the data. Thoughtful planning, diversification, and alignment with long-term goals continue to matter, especially when conditions feel anything but normal.

Sources:

[i] “2026 Equity Outlook: Great Potential,” Goldman Sachs, January 6, 2026

____________

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The S&P 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.