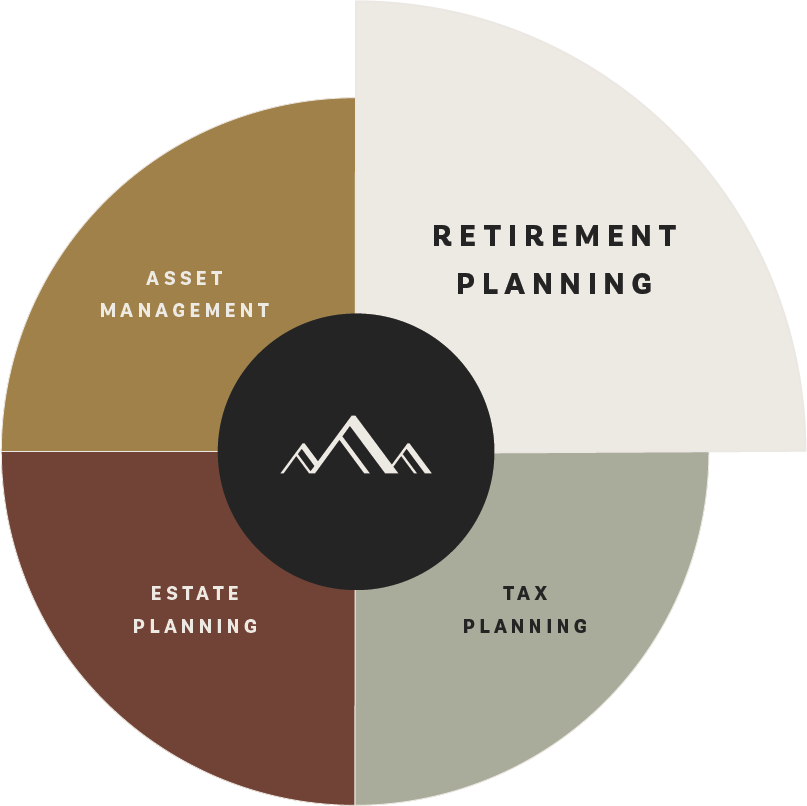

Wealth Management

Advising on every aspect of your financial life.

“We take comprehensive wealth management seriously—all of the individual financial pieces matter to the whole.”

Asset Management

in pursuit of long-term growth.

RSMA evaluates every client’s full financial picture to understand your short- and long-term objectives. But we also just listen.

Every client has different feelings about money, different values, different objectives, and different long-term desires and needs. All of this information factors into the asset allocation* decision.

Every client gets a customized investment portfolio based on your financial situation, goals, risk tolerance, time horizon, and liquidity needs.

RSMA builds—and actively monitors—portfolios using open architecture, investing across several categories of equities, fixed income, and alternatives. We make adjustments as necessary to capitalize on opportunities and to mitigate risks.

We conduct formal annual portfolio reviews to discuss performance, the market outlook, and to ensure your investments remain aligned with your goals.

*Asset allocation does not ensure a profit or protect against a loss.

Retirement Planning

to chart your path forward.

The combined expertise of Certified Public Accountants and Certified Financial Planners positions us to give comprehensive planning advice.

We help you establish and pursue savings goals based on how you want retirement to look and feel.

Annual cash flow and income analyses—which include helping you make decisions about Social Security, health care, and the timing of IRA distributions—give you a clear sense of how your net worth will meet your needs over time.

We closely monitor liquidity levels and projected tax liabilities, aiming to ensure you’re well-positioned to meet your needs throughout retirement.

Tax Planning

to mitigate liability and avoid surprises.

RSMA Wealth Management was co-founded by a CPA, which means tax planning has been a core focus since the firm’s inception.

We help clients determine how taxes can impact cash flow and liquidity needs in any given year.

Our comprehensive approach to financial planning means we understand our clients’ unique tax situations.

Tax planning becomes particularly impactful for clients with large estates. We work with your estate/tax attorneys to develop tax-efficient strategies for intergenerational wealth transfers, charitable giving, and more.

*RSMA Wealth Management and LPL Financial do not offer tax advice or services.

Estate Planning

to ensure your wishes are respected.

Proactive estate planning not only establishes a family’s wishes for how wealth is distributed and managed, it also creates structures and agreements designed to mitigate tax liabilities and protect family wealth.

At a minimum, individuals and families should have core estate planning documents in place: a will, healthcare directive, and updated beneficiaries.

We also advise on more complex estate planning situations, and work with estate and tax attorneys to establish plans.

Estate plans should be reviewed regularly. Laws change, family dynamics change, and financial assets, objectives, and aspirations often change. Estate plans should change with them.

*RSMA Wealth Management and LPL Financial do not offer legal advice or services.